How Does a Captive Insurance Company Operate? Charles Spinelli Explains

What is a captive insurance company?

A captive insurance company, also known as a single-parent captive or pure captive, is a wholly-owned subsidiary established to provide insurance coverage exclusively to its noninsurance parent company and affiliated entities or to an association.

In essence, captive insurance functions as a form of self-insurance where a corporation establishes a subsidiary insurer to deliver insurance protection for its operations. Furthermore, beyond serving its parent company, the captive insurer may extend its insurance services to additional businesses that become members of the captive entity.

According to Charles Spinelli, a parent company might opt to establish a captive insurance company to address risks that extend beyond the scope of traditional commercial insurance. This strategic move allows them to secure coverage for specific or unique risks that may not be readily available in the standard market.

Additionally, by setting up a captive insurance company, the parent company can potentially benefit from tax advantages, exercise greater control over losses, manage reinsurance more effectively, and have a higher level of oversight on costs related to insurance.

Captive insurance companies must adhere to relevant insurance regulations to ensure compliance. This includes maintaining solvency levels, actively participating in rate reporting, and upholding industry standards to protect policyholders and maintain financial stability.

What are some examples of Captive Insurance Companies?

Charles Spinelli mentions Jupiter Insurance, a well-known captive insurance company that gained attention following the 2010 British Petroleum spill in the Gulf of Mexico. Reports revealed that BP was self-insured by this Guernsey, U.K.-based company, potentially receiving up to $700 million in coverage for losses. This strategy is not unique to BP, as many Fortune 500 companies also utilize captive insurance subsidiaries.

A more recent illustration of this approach is the establishment of a captive insurance company by the state of Tennessee in 2022. This entity covers state-owned buildings, contents, including public college campuses, and general liability. As of July 2022, the captive insurance property is valued at $31.4 billion, showcasing the growing trend of organizations opting for self-insurance models to manage risks effectively.

As per a press release, the state’s Division of Claims and Risk anticipates that the captive will provide coverage for distinctive and challenging risks, leading to a reduction in overall insurance expenses. The release highlights that the utilization of a captive will enhance the State’s ability to assess and manage the risks associated with the Tennessee state government.

How does a Captive Insurance Company work?

Companies with high-risk profiles often struggle to secure suitable commercial insurance tailored to their specific needs. To address this challenge, a parent company can establish a captive insurance company, effectively self-insuring to manage risks.

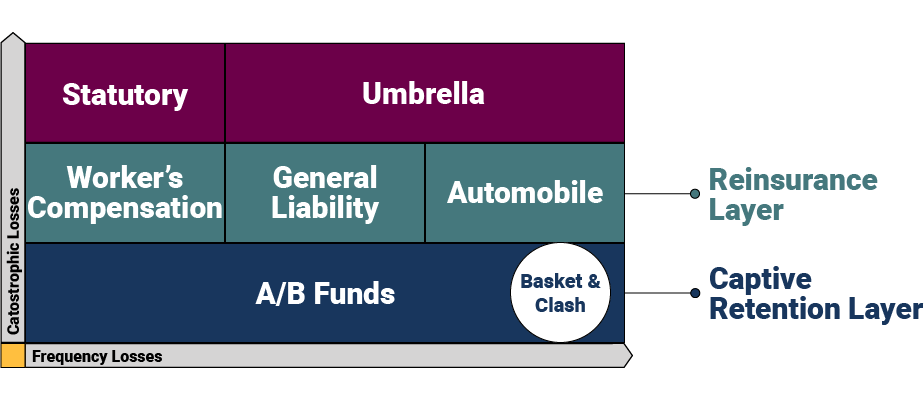

Charles Spinelli notes that captive insurance functions as a form of self-insurance, allowing a company or a consortium of companies to self-protect. A captive insurance entity may employ reinsurance strategies to bolster its coverage.

Reinsurance involves the transfer of risk from one insurer to another in return for a premium. For instance, a captive insurer might limit coverage to losses up to $250,000 per incident and utilize reinsurance for amounts exceeding this threshold.

There are tax benefits for establishing a captive insurance company. When a captive is structured appropriately, the premiums a parent company pays to the captive for coverage may be tax deductible.

Larger captives may also be exempt from paying taxes on their underwriting profits, which can lead to significant cost savings and financial advantages. This tax advantage can provide companies with more flexibility in managing their risk and finances, creating a strategic advantage in the competitive business landscape.

Captive insurance companies, which are entities set up by businesses to insure their risks, can be domiciled or headquartered in the U.S. or offshore locations such as Bermuda or the Cayman Islands. Charles Spinelli explains that this strategic choice is often made to leverage the benefits of more favorable tax laws in those jurisdictions.

Offshore captives commonly opt for a structure where a U.S.-licensed insurance company is involved in the underwriting and backing of their policies, ensuring compliance with regulatory requirements and enhancing financial stability.

Large corporations, nonprofit organizations, and professional associations often establish captives to manage risks effectively.

For example, the William Beaumont Hospital in Michigan set up Beaumont Physicians Insurance Company, based in the Cayman Islands, as a captive insurance entity.

This initiative aimed to provide physicians with accessible and cost-effective professional liability insurance, also known as medical malpractice insurance, ensuring comprehensive coverage for their practice.

Charles Spinelli writes about different topics on business. Read his blogs by clicking on this link.